Contents:

Sky-high house https://1investing.in/ have now begun to cool off slightly, with month-on-month sales prices dropping 11% from the record of June 2022. Interest rates continuing to increase will impact mortgage approval rates, slowing this section of the US economy further. Equally, we’re yet to see the full effect of the interest rates’ staggering climb. As borrowing costs, consumer spending and exchange rates are all affected, we’re only going to see the impact of the 2022 rate hikes this year. This won’t be popular in a market that’s seeing the inflation rate fall six months in a row, the IMF upgrading the US economy’s growth forecast for 2023 and a housing market already on its knees.

Speech by Governor Cook on the U.S. economic outlook and … – Federal Reserve

Speech by Governor Cook on the U.S. economic outlook and ….

Posted: Fri, 31 Mar 2023 07:00:00 GMT [source]

The government’s measure of housing inflation is slow-moving, Hunter said. Private-sector data shows rental growth is slowing “very sharply,” a trend that should show up in the CPI over the coming months, Hunter said. The housing sector is seeing the stickiest price increases and contributes to over 70% of the overall inflation increase. Housing prices rose 0.8% between January and February and 8.1% over last year.

And even amid continued rising prices, US consumers continued to spend, showing that pent-up pandemic demand was larger than expected. To find annual inflation rates for a calendar year, look to the December column. Meanwhile, the “Ave” column shows the average inflation rate for each year using CPI data. These average rates are published by the BLS but are rarely discussed in the news media, taking a back seat to the actual rate of inflation for a given calendar year.

U.S. Inflation Pace Slows for Sixth Straight Month in December

Here’s a guide to understanding what’s happening with inflation and how to think about price gains when navigating this complicated moment in the U.S. and world economy. Americans are confronting more expensive food, fuel and housing, and some are grasping for answers about what is causing the price burst, how long it might last and what can be done to resolve it. The Fed may get some unintentional help in its inflation fight from the aftereffects of the collapse of Silicon Valley Bank and New York-based Signature Bank. In response, many small and medium-size banks may pull back on lending to shore up their finances.

The CPI reading for November was the smallest 12-month increase since December 2021, and down from 7.7% in October. Create a free account and access your personalized content collection with our latest publications and analyses. The report reveals that the economic impact of COVID-19 is dominating companies’ risks perceptions.

Inflation has risen around the world, but the U.S. has seen one of the biggest increases

Invest in up to 20 stocks and ETFs by adding a single Kit to your portfolio. Our AI will rebalance your investments on a weekly basis to optimize performance. All you have to do is build a portfolio of Kits and leave the rest of portfolio management to AI.Download Q.ai today to start investing. This has drawn criticism from economic specialists for the Fed chair, with some arguing his too-upbeat focus on disinflation has given the markets false hope that talk of a recession is overblown. Despite this, the stock market has reacted positively to Powell’s words, enjoying a rally throughout January and spiking after the press conference. The S&P 500 is currently sitting 8% higher than at the start of the year.

The Federal Reserve has been on the warpath to beat spiraling inflation since the whole saga began. It raised interest rates from historic lows at a punishing pace, with four successive three-quarter point increases in 2022. You may also be interested in a table ofMonthly Inflation Rate data, which shows how much prices have increased over the previous month. The reason the Commissioner blames the rise on shelter costs, is because they make up a fairly significant portion of the total CPI making up 34.413% of the total index.

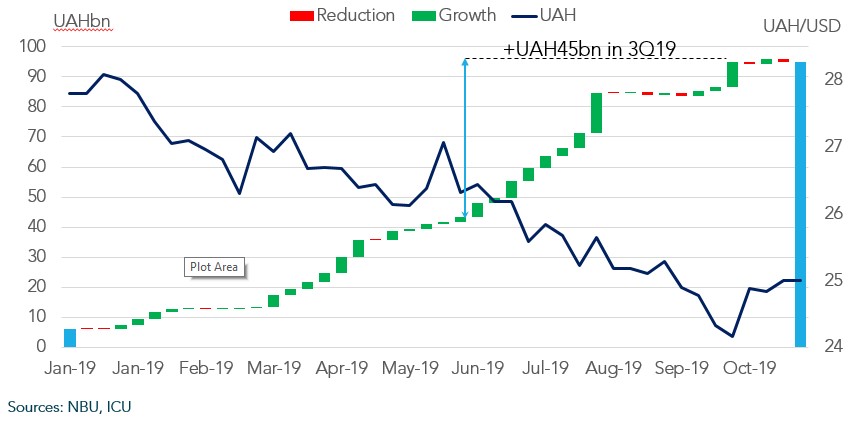

The following chart displays both the monthly inflation rates alongside the 12-month inflation rates since January 2013. The latter rates are the same as above and are not seasonally adjusted, while the former are seasonally adjusted. Both of these rates are headline figures in monthly Labor Department reports on consumer prices and inflation. For further details on the differences between seasonally adjusted and unadjusted data, please refer to “Seasonally Adjusted and Unadjusted Data.”

Now, we’re watching a delicate dance between the Fed, unemployment and interest rates unfold, aiming to tame the beast. The monthly percentage change in the Consumer Price Index for urban consumers in the United States was 0.4 percent in December 2022 compared to the previous month. In 2022, countries all around the world are experienced high levels of inflation. Although Brazil already had an inflation rate of 8.3 percent in 2021, compared to the previous year, while the inflation rate in China stood at 0.85 percent. One challenge for policymakers — and even more for families — is that price increases are surfacing in essentials.

Average mortgage interest rates

Even though prices are rising much faster than the Fed wants, some economists expect the central bank to suspend its year-long streak of interest rate hikes when it meets next week. With the collapse of two large banks since Friday fueling anxiety about other regional banks, the Fed, for now, may focus more on boosting confidence in the financial system than on its long-term drive to tame inflation. Instead, the supply chain issues continued, particularly because the Omicron variant emerged and proved difficult to control. Then Russia invaded Ukraine at the end of February, causing massive disruption to global supply chains, particularly in the energy market.

Policymakers are also particularly attuned to the so-called core inflation measure, which strips out food and fuel prices. While groceries and gas make up a big part of household budgets, they also jump around in price in response to changes in global supply. As a result, they don’t give as clear a read on the underlying inflationary pressures in the economy — the ones the Fed believes it can do something about. Nearly three-quarters of last month’s price increase was driven by housing costs. But most economists expect rental cost increases to slow in the coming months as more apartment buildings are constructed and new leases are signed at lower price levels. The data also follows the Federal Reserve’s move to raise its key federal funds rate another 0.75%, the fourth consecutive hike of its kind and the sixth increase this year.

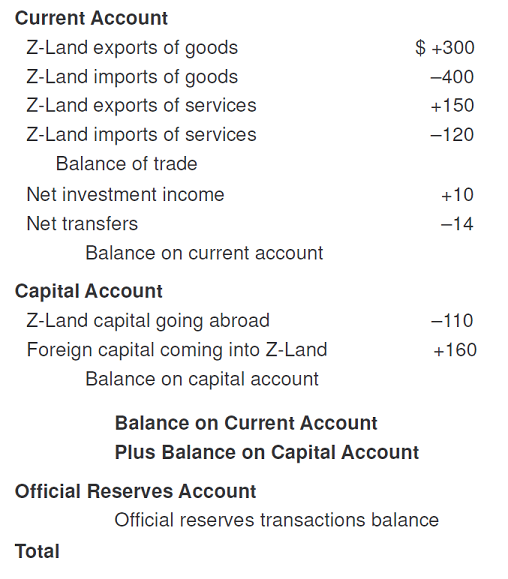

The government reported on Friday that consumer prices climbed 8.6 percent over the year through May, the fastest rate of increase in four decades. The Center relied primarily on data from the Organization for Economic Cooperation and Development, most of whose 38 member states are highly developed democracies. The OECD collects a wide range of data about its members, facilitating cross-national comparisons.

Money

“Commodities futures prices for grain have been high since the start of the Russian invasion.” Comerica Bank chief economist Bill Adams said house prices and rents are likely to decline throughout the U.S. in the coming months. We face big challenges to help the world’s poorest people and ensure that everyone sees benefits from economic growth. Data and research help us understand these challenges and set priorities, share knowledge of what works, and measure progress. For example, one of the worst cases of bird flu in U.S. history has led the price of eggs to surge more than most other food categories this year.

Inflation started at 7.5% in January and eventually climbed up to 9.1% in June, when gas prices were hitting $5 (£4) a gallon in some states. The inflation rate for gas prices alone was 60% at a time, largely because of repercussions from Russia’s invasion of Ukraine. Supply chain issues, sickness, death and the war in Ukraine upended global trade. Economists generally prefer using a so-called “core” inflation measure to gauge inflationary trends in the U.S. economy. This measure of CPI assesses prices without food and energy , which can experience big swings up and down from month to month. A decline in the inflation rate for electronics may seem counterintuitive when iPhones and other gadgets didn’t necessarily come with steep discounts in 2022.

It is typically expressed as the annual change in prices for everyday goods and services such as food, furniture, apparel, transportation and toys. Even if prices stop increasing altogether, the inflation that has already occurred will cost the average American household $9,038 over the next 12 months. Food prices rose 0.3% in February, the smallest monthly gain in nearly two years, though they’re still up more than 10% from a year ago. On a monthly basis, inflation increased 0.4%, compared with 0.4% in September. Mortgage interest rates don’t move in lockstep with the Fed’s actions in the same way that, say, rates for a home equity line of credit do. As a result, cooling inflation data and positive signals from the Fed will influence mortgage rate movement more than the most recent 25-basis-point rate hike.

Prices in February were 6% higher than a year ago, down from an annual rate of 6.4% in January and significantly lower than the 9.1% peak of inflation seen in June. Between January and February, prices rose 0.4% as prices increased in sectors including housing and food. The graph above shows the annual inflation rates in the US for the previous 10 calendar years, from 2013. To calculate cumulative rates between two different periods, you can use the United States Inflation Calculator. US inflation rates rose to their highest levels since the 1980s last year, thanks to a string of geopolitical tensions and pandemic-related economic decisions.

Did economists expect inflation to get this high?

Mr Biden in turn has pointed the finger at the war in Ukraine, which has hit oil supplies and exports of commodities like wheat, driving up prices and spreading the pain around the world. Oscar Jorda, senior policy adviser at the bank and one of the people who worked on the study, cautioned against reading too much into the exact percentages, but said the overall picture is clear. At its most recent Federal Open Market Committee meeting, Fed officials largely agreed that it was better to aggressively raise interest rates now to avoid economic pain down the road. We provide a wide array of financial products and technical assistance, and we help countries share and apply innovative knowledge and solutions to the challenges they face. Housing may prove to be stubborn for some time, however, given there’s typically a lag in rent and home price trends flowing through to the consumer price index.

GBP/USD Weekly Forecast: Buy the dips in the US inflation week – FXStreet

GBP/USD Weekly Forecast: Buy the dips in the US inflation week.

Posted: Fri, 07 Apr 2023 15:16:33 GMT [source]

The affluence within the united states Statistics will alter how it computes inflation data as of 2023. The switch to yearly weights will start on Friday, February 14, 2023, with the publishing of the CPI statistics for January 2023. Fed Chair Jerome Powell has stated that rates could peak higher than expected if the labour market remains strong. Other categories with declines over the month of December included used cars and trucks (a 2.5% decrease), airline fares (3.1%), and new vehicles and personal care, which each fell by 0.1%, according to the CPI report. Consumers actually saw overall deflation during the month largely due to plummeting gasoline prices from November to December.

- High prices for food, shelter and medical care sent the consumer price index for September up by 0.4%, compared to August’s 0.1%, according to data the Bureau of Labor Statistics released Thursday morning.

- The U.S. Federal Reserve and other central banks are trying to make sense of these multi-pronged inputs and tamp down inflation by raising borrowing costs for consumers and businesses.

- The government reported on Friday that consumer prices climbed 8.6 percent over the year through May, the fastest rate of increase in four decades.

- The food index increased 11.2% compared to the same month one year ago, or 0.8% compared to August.

- On the opposite end of the spectrum, some items had negative inflation rates in 2022.

“Thirty-year fixed mortgage rates will end the year near 5.25%,” he predicts. “Even though home prices in many parts of the country have fallen since the start of the year, high rates make buying prohibitively expensive for many,” says Jacob Channel, senior economist at loan marketplace LendingTree. It’s still difficult for many buyers, particularly those looking for their first home, to afford a monthly payment. The average interest rates for both 15-year fixed and 30-year fixed mortgages dipped. The average rate of the most common type of variable-rate mortgage, the 5/1 adjustable-rate mortgage, rose. Meanwhile, Fed Chief Powell has been talking about ‘disinflation’ but the strong job market may play the spoilsport in Fed’s action plan.